Who in your business manages the banking relationship? Do you have any insights on cash flow for the upcoming months? Can you identify which parts of your business are growing or declining? Are you able to see customer and activity trends before they happen? How do you know your business is performing better than your sector? You may not need a full time CFO but you certainly can benefit from the insights and perspective a CFO can provide.

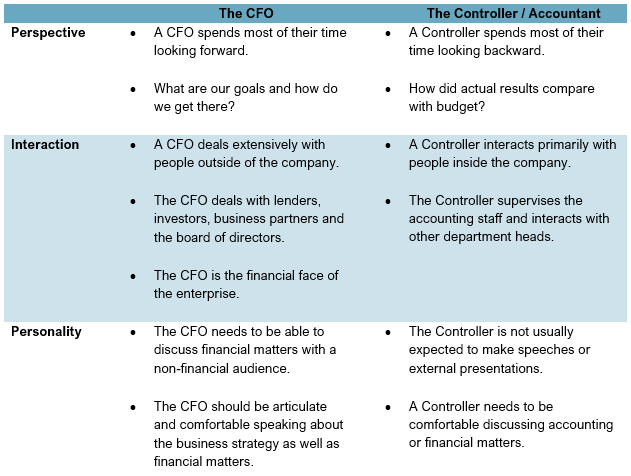

What is a CFO? How are They Different from a Controller or an Accountant?

Most businesses have a bookkeeper or a controller that prepare the financial statements regularly. However, the business owner is typically responsible for financial review, strategic planning, corporate development and more. A CFO can deliver much of this and can be a key resource when business owners make critical business decisions.

What does a CFO Do?

The CFO provides insight, guidance and management of a company’s financial functions. This can include:

The strategic and financial advice received from your CFO would provide you with options your business should consider with data to back it up. Your CFO would develop and track key metrics (both financial and operational) to help management better understand opportunities to make more money.

““Beyond simply not knowing that they need a CFO, they don’t want to spend the money. What many entrepreneurs don’t realize is that they’re already spending that money in lost profits and misspending.

They’re not seeing the dynamics of the business from an educated financial point of view. You can’t always go with your gut in making financial decisions, which is what a lot of entrepreneurs try to do.””

A good CFO helps you make more money, increase cash flow, improve your key financial relationships and provide a sounding board for strategic decision-making. Not all businesses need a full-time CFO. For companies that only require a part-time CFO, the Whitehorn team can be of assistance. We have over 10 years of experience working directly with private small to medium-sized business owners and have the know-how to help move your business forward.

Reach out to us today to find out how we can help you with interim CFO services.