2019 Developments

Venezuela Crisis: The Trump administration issued new sanctions on Venezuela’s state-owned oil company PDVSA that prevents current Venezuelan leader Nicolas Maduro’s regime from exporting crude to the US. The move increases pressure on Maduro to resign and cede power. Maduro’s regime has been accused of human rights violations and abuses, as well as widespread corruption. PDVSA’s US based refiner Citgo Petroleum Corp. will be able to continue operating in the US but will not be allowed to remit money to the Maduro regime. PDVSA is seeking to sidestep the US-imposed sanctions by asking major buyers to renegotiate contracts.

Production Curtailment and Alberta Government Programs: The Alberta government is easing mandatory oil curtailments imposed in January in response to the increase in WCS prices. The new target output in February is 3.63 million bbls/d, an increase of 70,000 bbls/d. The government claims that crude inventory has declined by 5 million barrels since the curtailment began in January.

The Alberta government will also shortly be announcing the winners of $1 billion in funding to develop bitumen partial upgrading facilities, and February will mark the deadline for the province to accept expressions of interest in a new bitumen refinery.

US Crude Production: Crude production in the US hit an all-time high of 11.537 million bbls/d in October 2018, up 79,000 bbls/d from 11.458 billion bbls/d in September. US oil production broke the 1970 record of 10.04 million bbls/d in November 2017 and has set monthly record highs for five straight months since June 2018. US gross natural gas production in the lower 48 states rose to an all-time high of 96.7 bcf/d in October, up from the previous high of 96.0 bcf/d in August (Daily Oil Bulletin).

Upcoming Projects

Husky’s Bid for MEG Energy Corp.

Husky Energy Inc. (TSX:HSE) abandoned its $2.75 billion hostile takeover bid for MEG Energy Corp. (TSX:MEG). The offer did not secure sufficient support from shareholders, with Husky citing “negative surprises” since it commenced its bid in October 2018. These surprises included the Alberta government’s production curtailment and a continued lack of progress on new pipeline development. Husky is proceeding with the potential divestiture of its retail business and its Prince George, BC refinery. Upon Husky retracting itself from the MEG acquisition, MEG announced a $200 million capital budget for 2019, a 70% reduction from 2018’s.

Completion of Christina Lake Phase G and Kirby North Projects

Cenovus Energy (TSE:CVE)’s 50,000 bbl/d Christina Lake Phase G expansion project and Canadian Natural Resources (TSE:CNQ)’s 40,000 bbl/d Kirby North Project are both slated to be complete and producing by the end of 2019.

imperial’s aspen project

Imperial Oil (TSE:IMO)’s $2.6 billion, 75,000 bbl/day Aspen SAGD project has begun construction with operation expected to begin in 2022.

Canadian Natural Resources Expansion

Canadian Natural Resources has submitted a bid for a bitumen-only 45,000 bbl/day expansion at its Horizon mine. This latest expansion will be for non-upgraded partially deasphated bitumen (PDB), similar in quality to diluted bitumen (“dilbit”) produced at Imperial Oil's Kearl Mine and the new Fort Hills Mine, operated by Suncor Energy (TSE:SU).

LNG Projects in canada

The $40 billion LNG Canada project to export LNG to Asia Pacific markets was approved in Oct 2018 and is viewed as the catalyst for additional LNG projects. There are 18 LNG export facilities proposed in Canada (13 in British Columbia, two in Quebec, and three in Nova Scotia) with a total proposed export capacity of 29 bcf/d (Natural Resources Canada).

Key Energy Charts

Exports climbed to 330,402 bbls/d in November 2018 from 327,229 bbls in October2018, which was the previous record. The trend is expected to continue increasing, with January rail-car loadings estimated at 356,000 bbl/d.

Notes: Data consists of 32 Canadian publicly traded E&P companies. 2016 to 2017 capital expenditures based on actual financial statements. 2018 capital expenditures are based on most recent company forecasts. 2019 capital expenditures are based on most recent company forecasts as well as analysts’ consensus.

The sector’s capital expenditures have been relatively flat since 2017. The primary reasons for the lack of growth are the volatility of commodity prices, uncertainty regarding large pipeline construction and competition for spending from other oil and gas producing regions. Most producers are emphasizing spending discipline entering 2019, with the operational flexibility to adjust spending plans based on market conditions. The most often cited reason for the decline in 2019 capital expenditures is the uncertainty around oil markets, including pipeline constraints, the impact of curtailments and pricing volatility. Many companies are also implementing a cautious and defensive approach by weighting their spending towards the second half of the year.

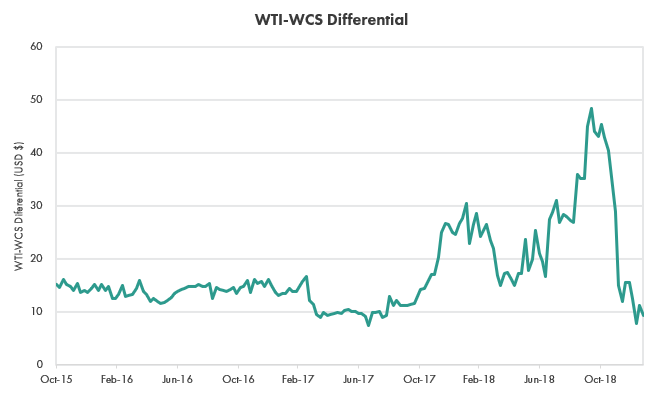

The price differential increased to record levels in Q4 2018 due to reduced demand caused by multiple US Midwest refinery maintenance programs, record Alberta production and the lack of pipeline capacity concerns. Since Q4, the Midwest refineries have resumed normal consumption. The Alberta government announced a temporary production curtailment and the global demand and supply for heavy crude has tightened. The current WCS-WTI price differential is ~15% or less than $10 per barrel.